Cryptocurrency Price List

| # | Name | Price (USD) | Chg (24h) | Chg (7d) | Chg (30d) | Market Cap | Volume (24h) | Price Graph (7d) |

|---|---|---|---|---|---|---|---|---|

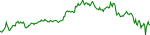

| 1 |  Bitcoin Bitcoin | $39,660.00 | 1.33% | -1.11% | 6.64% | $752.33B | $424.38M |  |

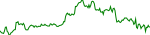

| 2 |  Ethereum Ethereum | $2,819.65 | 1.41% | 1.99% | 16.23% | $337.66B | $381.12M |  |

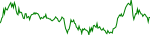

| 3 |  Tether Tether | $1.00 | 0.00% | 0.00% | 0.00% | $79.63B | $65.43M |  |

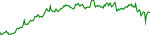

| 4 |  XRP XRP | $0.76 | 1.33% | -7.39% | 25.08% | $76.10B | $29.88M |  |

| 5 |  Binance Coin Binance Coin | $379.66 | 1.55% | -5.05% | -2.68% | $62.69B | $25.52M |  |

| 6 |  Terra Terra | $77.24 | -1.15% | 53.04% | 42.35% | $61.15B | $12.89M |  |

| 7 |  USD Coin USD Coin | $1.00 | 0.00% | 0.00% | 0.00% | $52.96B | $3.77M |  |

| 8 |  Solana Solana | $91.64 | 1.50% | 0.36% | 2.32% | $47.32B | $76.05M |  |

| 9 |  Avalanche Avalanche | $81.76 | -0.04% | -3.90% | 26.29% | $32.55B | $52.42M |  |

| 10 |  Cardano Cardano | $0.91 | 2.63% | -8.68% | -12.70% | $30.09B | $41.63M |  |

| 11 |  Polkadot Polkadot | $18.57 | 3.05% | 3.98% | 2.48% | $21.71B | $16.54M |  |

| 12 |  BUSD BUSD | $1.00 | -0.01% | -0.01% | -0.01% | $18.14B | $436,220 |  |

| 13 |  Dogecoin Dogecoin | $0.13 | 0.00% | -9.43% | -9.75% | $17.03B | $14.94M |  |

| 14 |  WETH WETH | $2,414.36 | -0.11% | -12.65% | 12.45% | $0 | - |  |

| 15 |  Polygon Polygon | $1.54 | 1.39% | -5.88% | -3.39% | $15.37B | $627.02M |  |

| 16 |  Shiba Inu Shiba Inu | $0.00 | 1.63% | -9.60% | 16.76% | $14.67B | $33.20M |  |

| 17 |  Axie Infinity Shards Axie Infinity Shards | $50.85 | 0.85% | -7.34% | 7.23% | $13.73B | $4.09M |  |

| 18 |  TerraUSD TerraUSD | $1.00 | -0.10% | 0.20% | 0.70% | $12.82B | $1.84M |  |

| 19 |  YAM YAM | $0.68 | -1.07% | 153.77% | 148.67% | $9.48M | - |  |

| 20 |  Wrapped Bitcoin Wrapped Bitcoin | $39,672.48 | 1.41% | -1.07% | 6.68% | $10.42B | $3.80M |  |

We have listed the top 20 cryptocurrencies by market cap and price as an aggregate from top cryptocurrency exchanges. We also have the cryptocurrency price change from the past 24 hours, 7 days and 30 days. Bitcoin is currently the top cryptocurrency so we compare each of the cryptocurrencies on the list to Bitcoin. We also have the cryptocurrency trade volume that have been traded at exchanges (Coinbase, Binance, etc.) over the past 24 hours.

Learn about the Top 20 Cryptocurrencies

Bitcoin was the very first cryptocurrency. Invented by an anonymous person(s) in 2009, it kick-started a revolution of new digital money and decentralized information networks. Bitcoin is likened to digital gold because it has a limited supply and can act as a store of value. It is censorship-resistant, pseudonymous, and an effective means of cross-border payments.

- It has always been the largest coin by market cap value

- It is the most accepted cryptocurrency by merchants

- It is estimated that over 4 million bitcoins have been lost

You can now loan bitcoin for 6% using our BlockFi Referral Code. Read our full review of BlockFi.com.

Ethereum is meant to be a decentralized world computer. It works as a general programming platform upon which other blockchain apps can be built. It uses its native currency ether as a way to exchange value and pay for computing power.

- Ethereum became popular as a platform to launch ICOs

- Many other coins are built on top of Ethereum technology

- In 2016, the largest app using Ethereum suffered a $60 million hack

Ripple is a real-time gross settlement network and payment network meant for regulated financial institutions to use. It is meant to streamline the onerous process for banks and eliminate third-parties like clearinghouses. Ripple’s native currency is called XRP.

- Ripple is being piloted by dozens of financial institutions all over the world

- The Ripple Company has other financial product that do not use XRP

- Ripple has a much faster settlement time than other top coins

Tether is a stablecoin. This means that it is pegged to the US dollar and rarely fluctuates beyond a 1:1 ratio. Tether is often used by traders to escape the massive volatility in crypto prices. One USDT is redeemable for 1 USD on select exchanges.

- When crypto prices fall sharply, Tether often has the highest daily volume

- There is no set limit for USDT and the company creates new coins regularly

- Tether is somewhat controversial for its banking relationships and lack of proof of reserves

Binance Coin began as a utility coin that is integrated in the Binance crypto exchange platform. Investors and traders on Binance can still use BNB for discounts on trading fees. Today, Binance Coin is also the native token of Binance Chain, an independent blockchain.

- Binance is one of the largest exchanges in the world

- Binance is headquartered in Malta

- Its CEO, named CZ, is one of the most prominent crypto entrepreneurs

Cardano is a protocol-layer blockchain platform that will support decentralized applications and the use of smart contracts. Cardano is aiming to add unique features, such as side chains and atomic swaps, for interoperability with other blockchains. It is also looking to add optional features like KYC/AML for financial institutions to help with regulations.

- Cardano’s founder, Charles Hoskinson, was also a founder of Ethereum

- The three entities running Cardano are: The Cardano Foundation, IOHK, and Emurgo

- Cardano has a rigorous academic peer-review process before any code is published

Dogecoin is a meme-inspired cryptocurrency that’s been around since December 2013. It is well-known for its vibrant community and its relationship with billionaire Elon Musk, who is an avid supporter of Dogecoin.

- DOGE is often merge-mined with Litecoin, due to having the same consensus algorithm

- Dogecoin was mentioned by Elon Musk on an episode of American sketch comedy show Saturday Night Live

- The maximum supply of Dogecoin is uncapped

USD Coin is a stablecoin created by Coinbase and Circle, which is pegged to the US dollar. It is designed to be a more legally-compliant stablecoin, which works within US laws and regulations.

- USD Coin is managed by a consortium called Centre, which is made up of Coinbase, Circle and other companies

- USDC was initially just an Ethereum token, but now runs on multiple blockchains

- The token’s US dollar reserves are accounted for by an independent firm every month

Uniswap is a decentralized exchange on Ethereum, which allows users to trade directly from their wallet rather than holding funds with a third party. The UNI token is used to govern the platform, giving holders voting rights for platform decisions.

- UNI tokens were initially distributed to platform users in a surprise airdrop

- Trades made on Uniswap require Ethereum “gas” fees, to pay for the transactions on the network

- Anyone can list an Ethereum token on Uniswap

Polkadot is a next-generation blockchain platform which aims to scale to real-world use cases. Polkadot connects multiple specialized blockchains into a single network, allowing for greater customizability and speed.

- The Polkadot mainnet was launched in mid-2020

- Polkadot was co-founded by Dr. Gavin Wood, who also co-founded Ethereum

- The DOT token underwent a “token split” in August 2020, splitting each DOT token into 100 smaller tokens

Solana is a high-throughput blockchain which uses a combination of proof-of-history (PoH) and proof-of-stake (PoS). It’s designed to solve scalability issues on the base layer, without a need for sharding or layer-2 solutions.

- Multiple Solana founders and developers came from semiconductor and software company Qualcomm

- The Solana blockchain can process more than 50,000 transactions per second

- Crypto exchange FTX has built its own decentralized exchange on Solana, called Serum

Stellar is an open-source payment network that relies on distributed ledger technology. Stellar is tackling the problem of making cross-border payments faster, cheaper and easier. It connects financial institutions and small businesses in different countries through its software, utilizing its native token Lumen, or XLM, as an intermediary to exchange between different currencies.

- The founder of Stellar, Jed McCaleb, was also one of the Ripple founders

- Stellar has fixed inflation mechanism of 1%

- Stellar has built-in voting functions for users

Polygon, formerly known as Matic Network, is a scaling solution for Ethereum. The platform is designed to make it easy to build and connect Ethereum-compatible blockchain networks for a multi-chain ecosystem.

- The project rebranded from Matic Network to Polygon in early 2021, but retained the MATIC ticker for its token

- Polygon has backing from crypto exchanges Coinbase and Binance

- The platform uses “checkpointing” with the Ethereum blockchain to enhance security

Binance USD is a stablecoin issued by Paxos, in partnership with the popular cryptocurrency exchange Binance. Each BUSD is backed by 1 US dollar held in an FDIC-insured bank.

- Binance USD is approved and regulated by the New York State Department of Financial Services (NYSDFS)

- BUSD is primarily an ERC20 token, but also exists on Binance Smart Chain

- An auditing firm provides monthly attestations for BUSD reserves

Bitcoin Cash is a fork of Bitcoin. Bitcoin Cash differs in certain technical elements that allow for more transactions per second on chain. Proponents think it is more important to function as payments system rather than as a store of value.

- Bitcoin Cash appeared after a long, dramatic schism within the Bitcoin community

- Bitcoin Cash’s logo tilts left and is sometimes green, while Bitcoin’s logo tilts right

- Bitcoin Cash later had several of its own forks

Litecoin is one of the earliest cryptocurrencies. It is a non-malicious fork of Bitcoin that gave it high transactions per second and a different mining algorithm. Litecoin is sometimes likened to silver in comparison to Bitcoin as gold. In history, silver was used more frequently for smaller transactions and gold was used less for larger sums.

- Litecoin was founded in 2011

- Litecoin’s founder, Charlie Lee, sold all of his Litecoin to avoid conflict of interest issues

- Litecoin is often used a test net for potential new changes to the Bitcoin protocol

VeChain is a supply-chain platform based on blockchain. It was created to make supply chains more transparent and efficient, by improving the storage and flow of information. The platform’s blockchain is called VeChainThor and VET is its native token.

- VeChain was co-founded by Sunny Lu, the former Chief Information Officer of Louis Vuitton China

- The platform also has a second coin, VTHO, which is used to pay for transaction fees

- The VeChain Foundation provides grants for projects building on the platform

Ethereum Classic is the original Ethereum chain, which was forked in 2016 due to the major hack of a smart contract called The DAO. The fork was designed to reverse the hack, which Ethereum developers believed to be too threatening to the future of the network.

- The ETC/ETH hard fork was the first ever hard fork of the original Ethereum protocol

- Ethereum Classic has been “51% attacked” multiple times in its history

- Advocates of the Ethereum Classic chain argue that it is the true Ethereum chain due to its history of immutability

Celsius Network is a cryptocurrency financial services platform. It allows users to earn interest on their crypto assets and use them as collateral to borrow cash. CEL is Celsius Network’s utility token, which can be used to access better interest rates.

- Borrowing cash against your crypto instead of selling it may save you from a taxable event

- CEL was launched in an initial coin offering (ICO) in 2018

- The more CEL a user holds, the better interest rates they get on the platform

Wrapped Bitcoin is a tokenized version of Bitcoin that exists on the Ethereum blockchain. Bitcoins are held in custody by cryptocurrency firm BitGo and issued as WBTC tokens on Ethereum.

- Being an ERC-20 token, WBTC can be used in decentralized applications

- WBTC has now also been launched on the Tron blockchain

- Proof of BitGo’s Bitcoin reserves can be viewed on the blockchain

EOS is also meant to function as a decentralized computing platform. It allows for other decentralized applications of all type to use it to power themselves. It is a competitor to Ethereum and other similar blockchains, much like how Windows OS and Mac OS compete.

- EOS had one of the longest and largest ICOs ever, raising close to $4B

- EOS’ founder, Dan Larimer, has founded several other blockchains, like Bitshares and Steem

- EOS does not charge transaction fees

Bitcoin SV stands for Bitcoin “Satoshi’s Vision”. It was created after a fork of Bitcoin Cash (which was originally a fork of Bitcoin). Similarly, the Bitcoin SV team wanted to make technical upgrades that allowed the network the capacity to handle an even larger volume of transactions.

- BSV was created in November 2018

- It was delisted on several major exchanges, such as Binance, Kraken and others

Tron is a blockchain-based platform that is looking to become a place for peer-to-peer sharing of digital entertainment content. It allows developers to build decentralized applications on top of its protocol, competing with Ethereum and EOS as a “world computer”.

- Tron’s team is mostly based in China

- Justin Sun is its young, social-media savvy founder

- 27 elected “super representatives” are in charge of verifying transactions on the network

Synthetix Network is a decentralized trading platform on Ethereum. It lets people create markets for real-world assets like stocks and commodities, which can be traded using cryptocurrency. SNX tokens are used as collateral to back these “synthetic” assets.

- Synthetix started as a stablecoin project called Havven

- Assets created on the platform are known as “Synths”

- Synthetix has its own stablecoin called sUSD (Synthetic USD)

Monero is a privacy-centric cryptocurrency aiming to allow all transactions to be completely anonymous and untraceable. Monero uses highly technical cryptography, such as ring signatures and stealth addresses, to make it virtually impossible for third-parties to track. By obscuring all addresses and transactions, proponents say it makes for a more useful and fungible currency.

- Most of Monero’s development team are, unsurprisingly, anonymous

- Monero is a fork of Bytecoin

- Monero uses an ASIC-resistant mining algorithm

Comments

Post a Comment